Understanding auto body repair pricing involves considering damage extent, vehicle type, and required services, ranging from hundreds to thousands of dollars. Insurance deductibles play a crucial role in out-of-pocket costs. Shops balance customer attraction and profitability by setting competitive rates, offering packages, and justifying prices with quality parts and techniques, building trust while ensuring fair pricing.

In today’s digital era, understanding auto body repair pricing is crucial for both insurance providers and shop owners. This article navigates the complex landscape of auto body repair costs, specifically focusing on insurance deductibles and their impact. We’ll delve into how to set competitive pricing for your shop while ensuring transparency and fairness for policyholders. By exploring these key aspects, we aim to revolutionize the way auto body repair services are priced and perceived.

- Understanding Auto Body Repair Costs

- Insurance Deductibles: What You Need to Know

- Setting Competitive Pricing for Your Shop

Understanding Auto Body Repair Costs

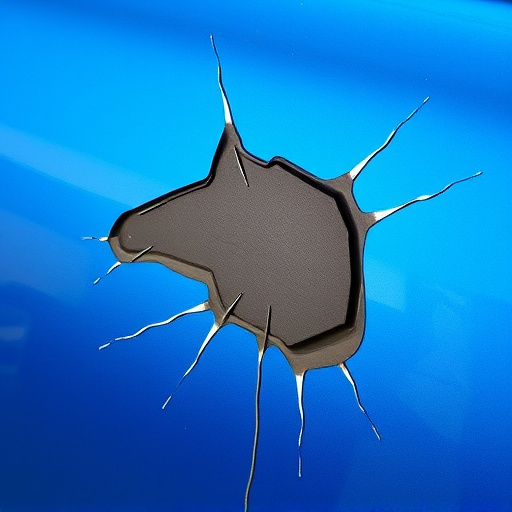

Understanding auto body repair costs is essential when navigating insurance claims and deductibles. Auto body repair pricing varies widely depending on several factors, including the extent of damage, type of vehicle, and specific car paint services required. For instance, minor dents and scratches might only cost a few hundred dollars in parts and labor, while more extensive repairs such as major crashes or structural damage can lead to bills that stretch into the thousands.

Insurance companies often set limits on what they’ll cover, so it’s crucial for policyholders to be aware of these deductibles and out-of-pocket expenses. Compare quotes from different auto body repair shops to get a sense of average pricing for your region. Keep in mind that while cost is important, quality craftsmanship and using genuine parts are equally vital to ensure long-lasting repairs and the safety of your vehicle.

Insurance Deductibles: What You Need to Know

When it comes to understanding auto body repair pricing, one of the key factors that influences the cost is your insurance deductible. An insurance deductible is the amount you agree to pay out-of-pocket for repairs before your insurance coverage kicks in. This amount is typically set by your insurance policy and varies depending on your chosen coverage limits. It’s important to review your policy documents carefully to comprehend the specifics of your deductible, including whether it’s a flat rate or calculated based on repair costs.

Knowing your deductible is crucial when considering auto body repair pricing, especially after incidents like collisions, fender benders, or hail damage. These events often result in substantial repairs, and insurance adjusters will apply your deductible to the overall cost. For instance, if your deductible is $500 and the estimated repair bill totals $2,000, you would be responsible for paying the initial $500 out of pocket before your insurance coverage covers the remaining balance. Being aware of these costs can help you prepare financially and make informed decisions when selecting auto body repair services.

Setting Competitive Pricing for Your Shop

Setting competitive pricing for your auto body repair shop is a delicate balance between attracting customers and ensuring profitability. In today’s market, where consumers are price-conscious yet demand quality, it’s crucial to understand your competition and the value you bring. Researching industry standards and local market rates will give you a benchmark to work from. Consider offering packages or discounts for specific services, especially for fleet repair services or long-term clients, to gain an edge over other collision repair centers.

Remember, auto body repair pricing should reflect not only the cost of materials and labor but also the expertise and reputation of your shop. Incorporating innovative techniques and high-quality parts can justify slightly higher rates, while staying competitive overall. This approach fosters trust with customers, assuring them they’re receiving excellent vehicle bodywork repairs without overpaying.

When setting auto body repair pricing, balancing customer expectations and sustainable business practices is key. By understanding insurance deductibles and offering competitive rates, shop owners can foster trust with clients while ensuring their shop remains profitable. Remember, transparent pricing strategies that align with industry standards are essential for long-term success in the auto body repair market.